Endowments

Our Financial Future

The DU Endowment is built on the generosity of donors and alumni. The funds are used for new facilities, programming, professorships, student aid and more. Over the years, the endowment has changed lives both on and off campus, supporting students and alumni with immersive educational experiences, career development services and other opportunities.

About the Endowment

A Message from Edward T. Anderson, BFA ‘71, Trustee & Investment Committee Chair

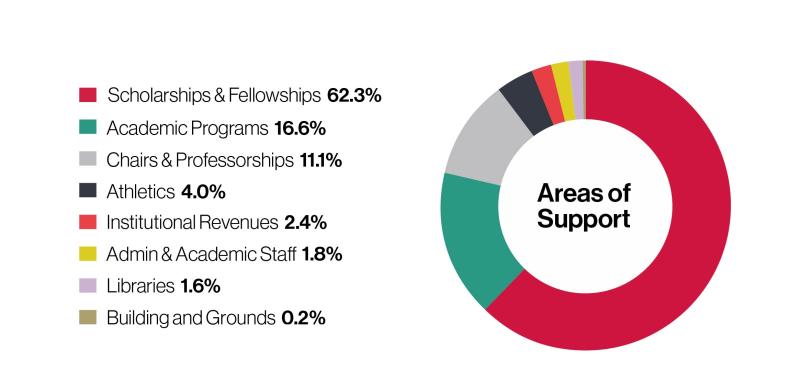

What does the endowment support?

The DU Endowment empowers students, faculty and the University to create meaningful change throughout our communities – all made possible by gifts from the global DU community.

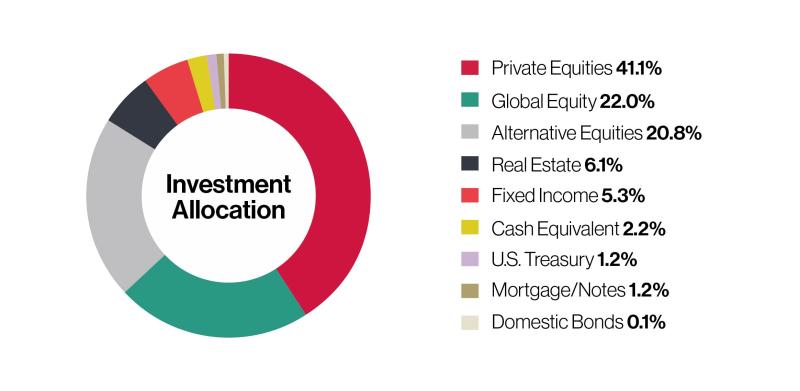

What are we invested in?

We have built modern portfolio with a significant strategic commitment to private market strategies. We have achieved that goal through our partnership with Investure, LLC and believe we are well positioned for the future.

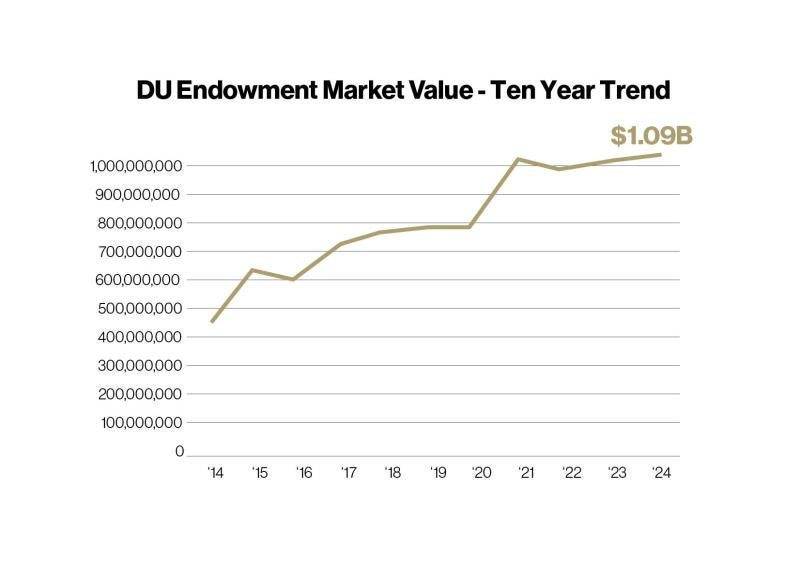

The DU Endowment over time.

The University’s endowment is a key source of both operational funding and a long-term financial resource that supports DU’s vision for future growth. The market value of the endowment ended the year at $1.09 billion, net of new gifts and withdrawals to support the University.